Exness Scalping Strategy: A Comprehensive Guide

The Exness scalping strategy has gained traction among traders due to its potential for generating quick profits from small price movements. Scalping involves making rapid trades to capitalize on minor fluctuations in the market. In this article, we will explore the essential elements of a successful scalping strategy on the Exness platform and how traders can optimize their performance. For further insights, you can also check out this Exness scalping strategy https://e-tisrl.com/2025/05/20/beginning-and-definition-of-xau-as-a-symbol-of/ on trading strategies.

Understanding Scalping in Forex

Scalping is a popular trading strategy that involves opening and closing trades in a very short period—sometimes within seconds or minutes. The objective is to make small profits that accumulate over time. Scalpers often place dozens or even hundreds of trades in a single day, relying on high liquidity and low transaction costs to succeed. Exness offers a robust trading environment that suits scalpers thanks to its low spreads and high execution speed.

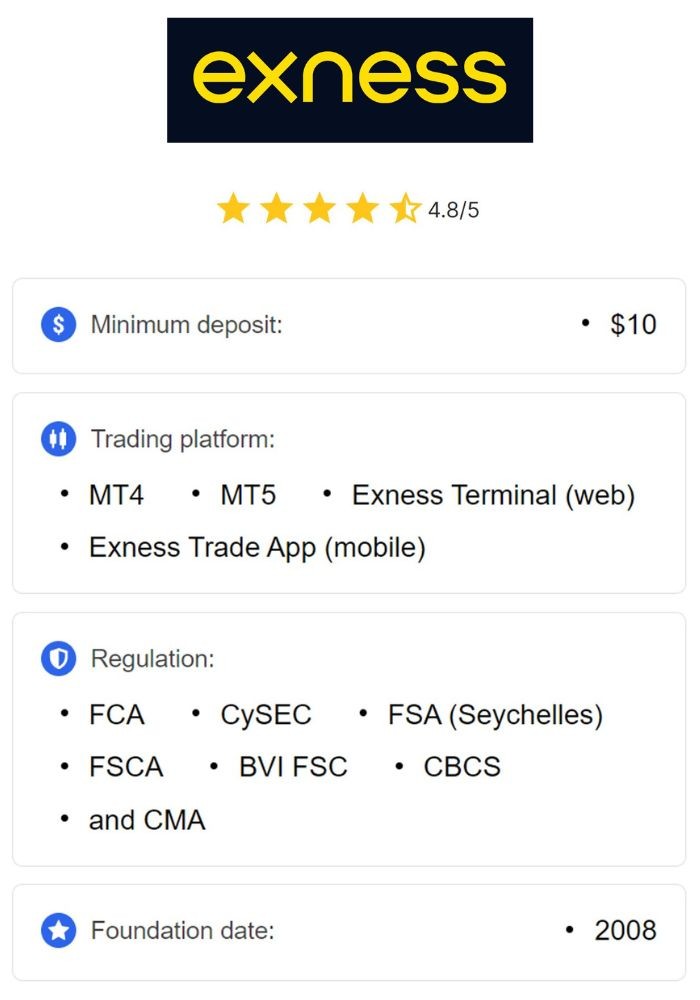

Key Features of the Exness Trading Platform

When employing a scalping strategy, having a platform that caters to your trading style is crucial. Here are some key features that make Exness a favorable choice for scalpers:

- Low Spreads: Exness offers competitive spreads, which is vital for scalpers who require minimal costs between the bid and ask price.

- High Leverage: The platform provides high leverage options, enhancing potential profit margins. However, traders must be cautious as leverage also increases risk.

- Multiple Account Types: Exness features various account types suitable for different trading styles, including standard accounts and those intended specifically for scalping.

- Fast Execution: Scalping strategies depend on the speed of order execution. Exness is known for its efficient trade execution, which helps scalpers perform effectively.

Essential Components of a Scalping Strategy

A profitable scalping strategy involves several key components:

- Timeframe Selection: Scalpers typically operate on short timeframes, such as 1-minute (M1) or 5-minute (M5) charts. This allows traders to spot quick opportunities and react swiftly.

- Indicators and Tools: Utilizing technical indicators, such as moving averages, RSI (Relative Strength Index), or Bollinger Bands, can assist in identifying entry and exit points.

- Risk Management: Since scalping involves making multiple trades, risk management is crucial. Implementing stop-loss orders and only risking a small percentage of your capital on each trade can protect against significant losses.

- Market Analysis: Understanding market conditions, trends, and news events can improve trading results. Scalpers should stay updated on economic news that can cause price fluctuations.

Developing an Effective Scalping Strategy

Here’s a step-by-step approach to developing your Exness scalping strategy:

1. Choose the Right Currency Pairs

Selecting highly liquid currency pairs is essential for scalping. Major pairs like EUR/USD or GBP/USD typically exhibit enough price movement with low spreads, which are ideal for scalpers.

2. Set Up Your Chart

Using a platform like Exness, set up your chart with the chosen timeframes and indicators. Consider using a combination of indicators to confirm signals. For example, the confluence of a moving average crossover along with RSI showing oversold or overbought conditions can signal a strong trade opportunity.

3. Develop Entry and Exit Rules

Establish clear entry and exit criteria. For instance, you could enter a trade when a short-term moving average crosses above a longer-term moving average, and exit once you’ve achieved a small profit or your stop-loss is hit.

4. Continuous Monitoring

Scalping demands constant attention. Be prepared to make quick decisions and adjustments to your trades based on real-time market movements. Ensure you have a reliable internet connection and a distraction-free trading environment.

Psychological Aspects of Scalping

Trading psychology plays a significant role in scalping. Here are some tips to maintain a disciplined mindset:

- Stay Calm: Avoid emotional trading decisions. Keeping a clear head is crucial for executing your strategy effectively.

- Be Patient: Not every moment will be the right time to trade. Wait for your criteria to align before entering a position.

- Accept Losses: Losses are a natural part of trading. Embrace them as learning experiences and refrain from trying to chase losses.

Final Thoughts

The Exness scalping strategy can be an effective approach for traders looking to capitalize on small price changes. With its low spreads, high-speed execution, and user-friendly platform, Exness provides an excellent environment for scalpers. By developing a well-structured strategy, focusing on risk management, and maintaining psychological resilience, traders can maximize their chances of success. As with any trading method, practice on a demo account is recommended to refine your skills before trading with real funds.